Proxy Contest SCOR

Denis Kessler

a Chairman without real counterpowers

DENIS KESSLER

An Omnipresent and Overly Influential Chairman

Despite our demands, SCOR refuses to specify for how long Denis Kessler would remain Chairman

If he is unable to maintain his role as CEO, how can he remain as Chairman in the long term?

Without any valid explanation of the reasons of his resignation, how can we be sure that it is not a personal maneuver to remain Chairman as long as possible?

The succession is now underway, and the future CEO has a long experience of SCOR and the reinsurance sector: Denis Kessler's departure will no longer put SCOR at risk and will, on the contrary, be beneficial for SCOR's performance

Denis Kessler's prolonged stay as Chairman would be problematic due to the structural dysfunctions in SCOR's governance,

Furthermore, it is not justified given the poor performance achieved by SCOR under Denis Kessler's last mandate period, and the experience of the future CEO

Denis Kessler has the longest tenure (c. 19-year tenure, vs. an average tenure of 3.9 years for other board members)

Questionable independence of most board members

Close historic ties between the Lead Director Augustin de Romanet and Denis Kessler

Board leniency reflected in generous pay practices

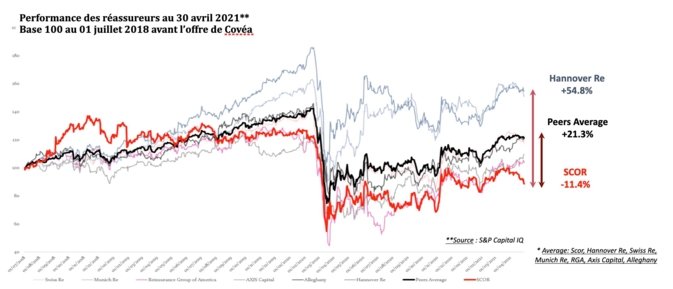

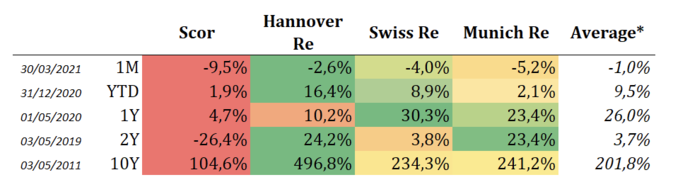

Worst stock performance among its peers (between March 2019-2021: -16.4%, vs. +35.0% for Munich Re and +30.8% for Hannover Re

(from 03/28/2019 to 03/29/2021)

There is a Kessler’s discount on the share price of SCOR

Therefore, it does not justify keeping Denis Kessler as Chairman, especially since the appointment of an experienced CEO

SCOR’s Performance is still Below Direct Peers: the “Kessler’s discount” effect

Insufficient Performance: Underperformance is evident relative to peers

Compensation is not aligned with share price performance

Denis Kessler has already been offered a grace period in the past, with the statutory age limit extended to 70 years old.

However, this extra time in power came with unsatisfactory performance.

Performance of Reinsurers as of April 30th 2021

Base 100 at July 1st 2018 before Covéa’s offer

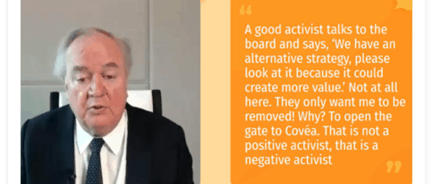

Denis Kessler: when a self-promoting podcast

highlights his disdain towards minority shareholders

Denis Kessler was interviewed in April 2021 and talked almost immediately and lengthily about CIAM: See from 4.06’ to 12’ of the TV Interview

His point is inconsistent and simply dishonest:

According to Denis Kessler, “CIAM does not have an alternative strategy”, CIAM is a “negative activist” and CIAM “only wants [Denis Kessler] to be removed” to “open the gate to COVEA”

FACTS

CIAM has absolutely no links with COVEA

FACTS

CIAM wants safeguard mechanisms in place to ensure a proper balance of powers and to guarantee that the succession will take place.

Denis Kessler did not say a word about M. Ribadeau-Dumas during the whole interview (and with good reason) but instead referred to his successors as “people” which will “run around the world like rabbits”.

Was it already intended that Benoit Ribadeau-Dumas would be replaced ?

FACTS

CIAM has rightfully highlighted since 2019 strong governance deficiencies and repeated problematic practices, apparently shared by many shareholders considering the constant level of dissent at SCOR’s AGMs. This already led to some improvements made to pay practices and forced SCOR to announce the separation of powers

LES FAITS

CIAM does not want to disrupt the company’s strategy but instead advocates for better corporate governance standards

PROXY ADVISORS' OPINIONS

Opinions from Glass Lewis, ISS and Proxinvest

Far from being the lone rider described by Denis Kessler, CIAM merely points out the problems of good governance posed by its omnipresence and omnipotence.