Proxy Contest SCOR

An Opaque and Inadequate

Compensation Policy

DENIS KESSLER'S COMPENSATION

Board leniency: reflected in generous and contested remuneration practices

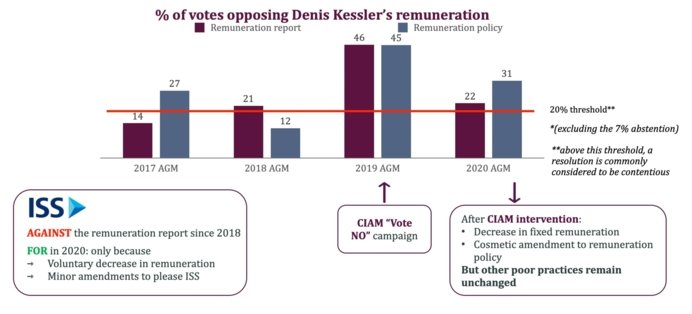

Year after year, an opposition marked and repeated on pay proposals

Despite ISS support, 2020 opposition remains high.

Shareholders are not fooled by superficial changes made to the pay

Remuneration Report (item 5)

A Poor Performance compensated by

discretionary qualitative criteria

Profitability

Ponderation

(financial criteria)

50%

% achievement

0%

BOARD's ASSESSMENT

n/a

Shareholders’experience

55% underperformance of the ROE compared to the target

-30% in the FY20 Share Price

2020 Net income Divided by Two vs. 2019

Achievement of the Quantum Leap Strategic Plan

PONDERATION

(NON-FINANCIAL CRITERIA)

15%

% ACHIEVEMENT

75%

BOARD'S ASSESSMENT

Highlighted the “positive growth both in life and non-life reinsurance”

SHAREHOLDERS’EXPERIENCE

1.4% growth in life reinsurance vs. a 3-6% targeted range

2.4% annual growth in non-life vs. a 4-8% targeted range

Estimated impact of the COVID-19 crisis: 314 million in life reinsurance 284 million in non life

Fight against

Climate Change

PONDERATION

(NON-FINANCIAL CRITERIA)

10%

% ACHIEVEMENT

150%

BOARD'S ASSESSMENT

Publication of SCOR’s first climate report

SCOR’s ranking in the “Insuring Our Future” report

SHAREHOLDERS’EXPERIENCE

Downgrade in CDP’s rating from C to D

The "Insuring Our Future" report highlighted that “significant loopholes remain in the fossil fuel policies adopted by SCOR”

CSR / Human Capital management

PONDERATION

(NON-FINANCIAL CRITERIA)

15%

% ACHIEVEMENT

150%

BOARD'S ASSESSMENT

Good results in terms of internal mobility or coverage by the Leadership & Organization Review

Refer to a “talent management” objective

SHAREHOLDERS’EXPERIENCE

Lower results than last year (where the same criteria was only partially met)

SCOR has not yet introduced annual surveys or commitment scores. The example to follow is that of Swiss Re, which uses an external service provider for this purpose.

Benoît Ribadeau-Dumas was recruited externally... An eventful succession

The 2020 bonus of Denis Kessler is disconnected from SCOR’s performance

A quantum allocated mainly by an opaque assessment of non-financial criteria

A winning result

even with 0% financial criteria met!

2020 outcome: STI payout of 62.25% of fixed pay

(STI : Short Term Incentive)

CIAM's Analysis

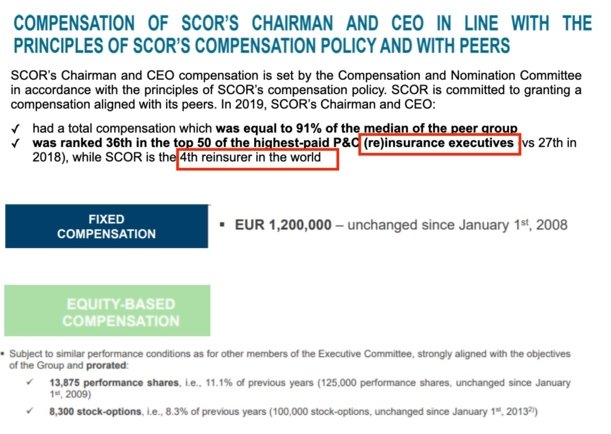

A manipulated benchmark

SCOR compares Denis Kessler’s remuneration to all insurers and reinsurers (including in the United States)... But conveniently excludes the insurance sector when evaluating his performance!

No pro-rata?

Contrary to Laurent Rousseau, it is not explained that Denis Kessler's fixed salary as Chairman-CEO will be pro-rated to his time passed as Chairman-CEO in 2021

LTIP

Even prorated, an award in the year of departure is contrary to good practices

What about LTIP in 2020? Denis Kessler received more than 3 million euros in shares and stock options in April 2020 (share price approximately 25% lower than a share price taken at the normal allocation period - see appendix 6)

These depend on performance conditions assessed over the period 2020-2022... Yet Denis Kessler will no longer be in power as of mid 2021!

Will the final amount of this award be reduced accordingly?

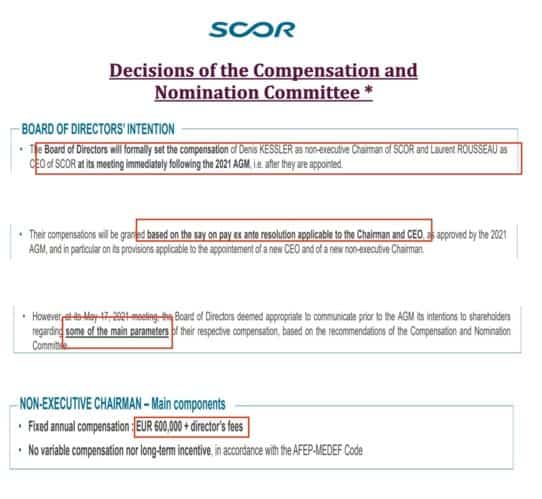

The remuneration policy for Denis Kessler as non-executive Chairman is particularly opaque

No to blank check !

The Board's intention is to have SCOR shareholders vote on decisions to be taken after the AGM...

Once again, a certain lightness with the remunerations

A single resolution for 3 different policies... Unheard of?

What other parameters are being kept from us?

The Board chooses as it wishes what it will or will not present to the shareholders

Compensation excesses continue

A significant remuneration for a non-executive Chairman...:

- Combined with directors' fees

- Combined with an exorbitant retirement pension?

- No information on the subject!

- However, most companies communicate this and some even suspend the payment of the pension for the duration of the mandate (L'Oréal, AXA)

€996,697 of estimated annual pension,

one of the most generous pensions in France

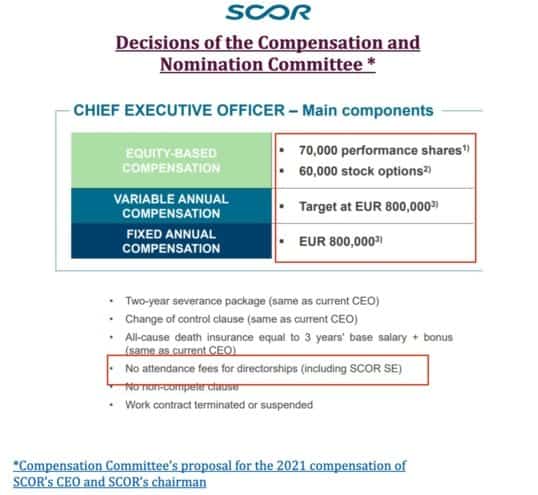

The remuneration policy for Laurent Rousseau as CEO:

the proof that Denis Kessler was overpaid during all these years…

A much inferior package than Denis Kessler’s

-42% compared to Denis Kessler

(125,000 shares of performance, 100,000 stock options per year)

-33.33% compared to Denis Kessler

EUR 1,200,000 of fixed remuneration and target annual bonus)

Furthermore, what about the maximum bonus limit?

No director’s fees

While Denis Kessler received an average of 70,000 euros in fees per year (and will continue to receive them)

Proof that the Board knows how to show moderation… except for Denis Kessler!